Your credit score is an important factor in determining your eligibility for a personal loan. Lenders will approve loans to people with different credit scores. A higher score generally means better terms and lower interest rate. However, your credit score is only one part of the equation. Other important factors are your annual income and employment status. You also need to provide details about how you intend on using the loan.

A good credit score is 660

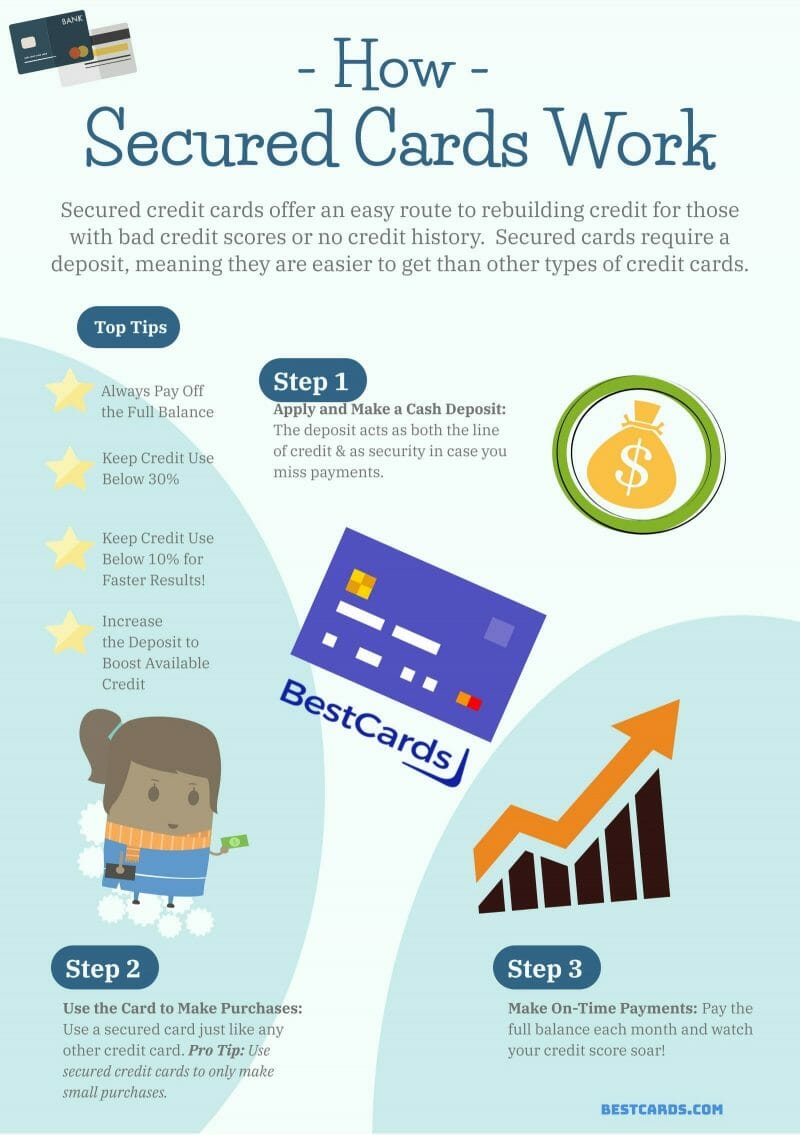

It is possible to qualify for a personal loans if your credit score drops below 660. Before applying for a loan, you should consider the type of loan and the rate. Avoid payday loans or unsecured personal loans. This will only make it more difficult to pay off long-term debt. Credit builder loans are a better option that will help you build credit.

If you have a credit score of 660, you should focus on repairing negative items on your report. This is the fastest and most effective way to boost your credit score. This can be done by calling a credit repair professional and having your report reviewed. They can walk you through the process, and they will even give you a free consultation to help improve your score.

Fairness is defined as 660

Having a 660 credit score is considered fair credit. It means that you have some negative items on your credit report, but there are ways to improve your credit score. Eliminating any negative items from credit reports is the fastest and easiest way to improve it. Credit repair experts can help you with this process. Receive a complimentary consultation and find out how you can improve your credit score quickly.

Credit score will play a significant role in your ability to get a personal loan. A credit score below 660 can make it difficult to get approved for the loan you need. A loan may still be possible, but the interest rate will likely be higher. Lenders are more likely to lend to borrowers with excellent credit scores or close to perfect credit. But, they will consider other factors. Your credit score will improve if your ability to pay your bills on time and maintain a low balance.

650 is considered good

A credit score above 650 may be enough to qualify you for a personal lender loan. A high credit score will increase your chances of getting a loan. It is important to know that your credit score will depend on a variety of factors. It is important to pay your bills on time. Late payments will only make the situation worse.

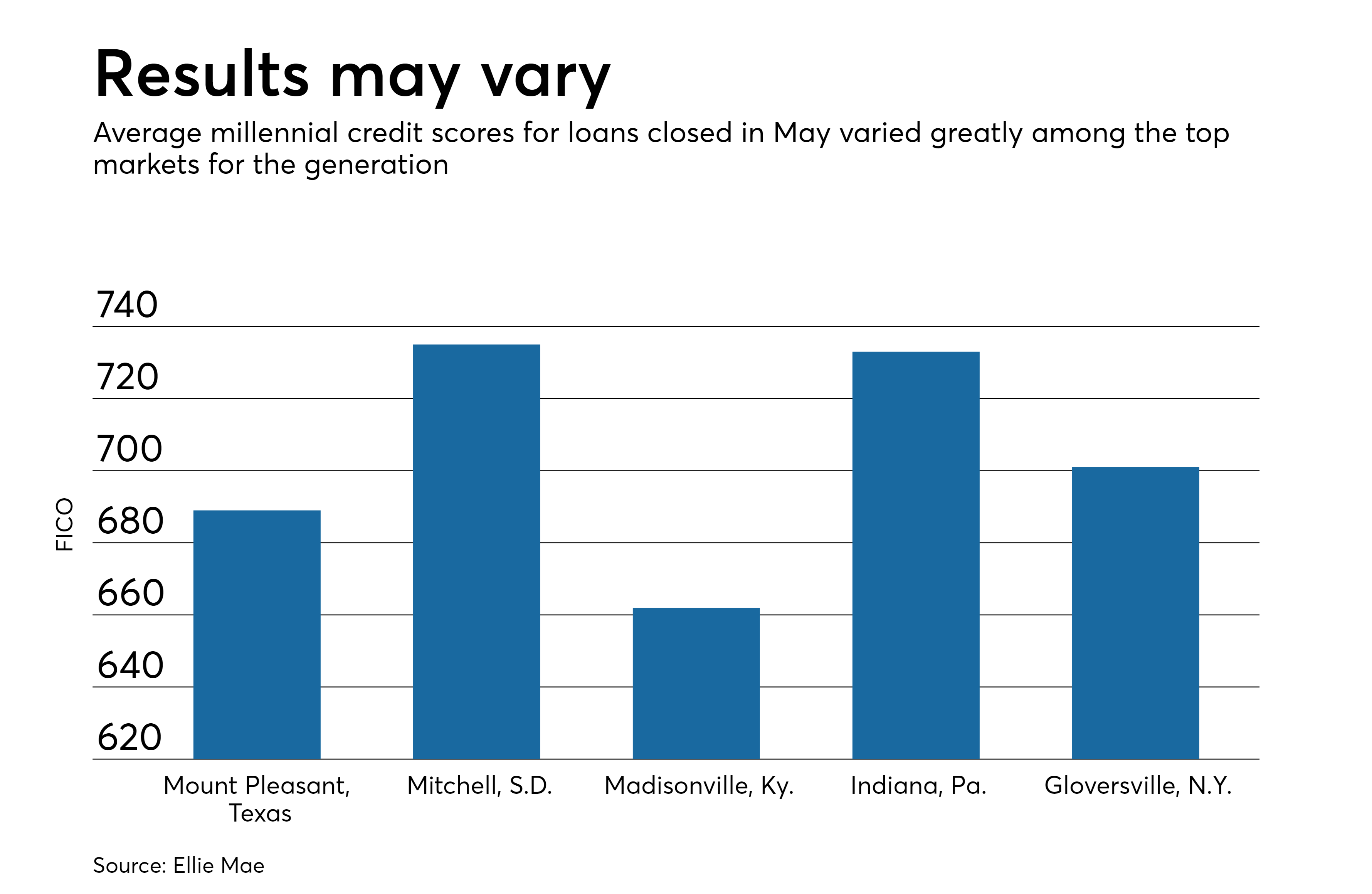

You can improve your credit score by checking your credit report. There are a number of ways to do this. A solid credit history can help improve your chances for approval. This is possible by paying your bills in time and adhering to sound financial habits. Lenders will consider your FICO score. This is calculated based on information that you have filed with the three major credit bureaus. These bureaus include Equifax Experian and Transunion.

Remember that bankruptcy does not disappear from credit reports until seven years after it is filed. While it may be possible to get the bankruptcy off of your report earlier, this can be a difficult process. Hard inquiries can be a negative factor in your score. They will remain on your record for up to 10 years. These inquiries will eventually diminish in impact. If the inquiry appears on your credit file, you can attempt to dispute it. This is particularly useful if your identity has been stolen.