A credit card can be a great way to build credit. However, it is important that you pay off your debts promptly. Paying your bills on time and setting autopay are great ways to build credit. To build good credit using a creditcard, the most important tip is to make sure your accounts are open. Here are some guidelines:

Building credit with a credit card

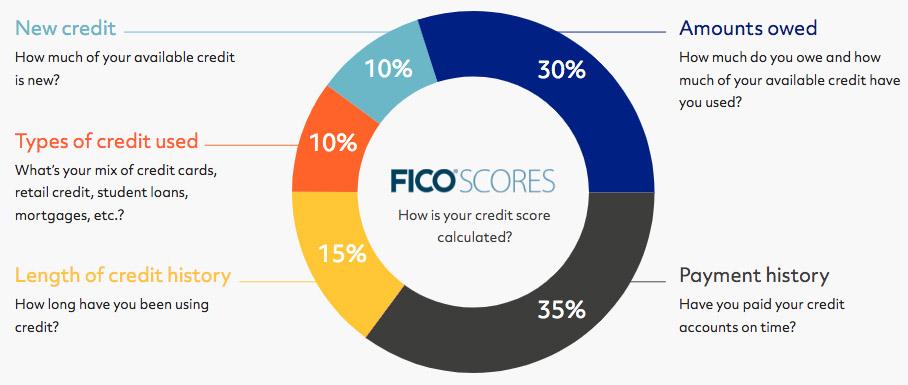

If you want to improve your credit, the best way is to use your card every month and make all your payments on-time. To improve your credit score, try to keep your credit limit at 30 percent of your available credit. Autopay will pay your minimum purchase amount automatically and give you more discretion. It is important to not go over your credit limit and end up paying more than you should.

A secured credit card can be a great option if you are just starting your credit rebuilding journey. To obtain a secure card, you'll need to deposit $200. Once you have your card, you'll be granted a credit limit. It is typically the same as the deposit. Certain secured cards may require higher deposits while others don't. You should always be aware of the amount of money you are required to deposit, as this will help you to determine whether or not you should obtain a higher credit limit.

To pay off your debt, you can use a credit card

It can be overwhelming to have too many credit cards. Smart money decisions can help you reduce your debt. This article will explore several approaches to debt management. Continue reading to learn how to responsibly use credit cards and improve your credit scores. Talk to a financial advisor to help you decide the best strategy for your situation. These are some helpful tips:

When using credit cards to pay off debt, it is essential to read the terms and conditions of each card. When you get your credit card, the issuer will provide these terms. This information can be useful for managing your spending habits, and ensuring that you make timely payments. While cleaning up your credit can be a lengthy process, it does not need to be difficult. Remember that credit cards are an excellent financial tool, but if you're not careful, you may end up with too much debt.

You can set up autopay for credit building with a Credit Card

You can set autopay to pay a monthly amount. However, it is important that you are able to cover the amount. You can usually set autopay to pay a specific amount. However, it is important that you keep track of your account balance as overdraft fees and return payments could occur if you fail to pay. Autopay offers many benefits. It saves you time and money.

Autopay makes it easy to pay your bills on time and improves credit score. It is possible to set up autopay through your company's billing system or directly through your bank account. Autopay makes it easy to pay your bills on time each month. This helps maintain good credit scores. You have the option to set autopay at a lower rate than the one that you were paying before.

To build credit, it is important to keep accounts open

Creditors will find you more predictable the longer your credit history. This is why keeping your credit card accounts active is so important. Closing your accounts will reduce the average age of your accounts and hurt your overall credit score. Credit Strong can help you build your credit history. These accounts can provide 120 months of history and are easy to cancel. If you do not need them, it is best to avoid opening credit cards.

It is crucial that you make all payments on time. Your credit score will be affected if you miss any payments. Many financial institutions will report late payments directly to the credit bureaus. This can cause a bad credit rating. Don't mistakenly think of your credit card like a debit card if you want to improve your credit score. To avoid racking up debt, you should pay the full amount each month.