Although there is no one-size fits all, building credit steadily can help you get a better understanding of your financial future. This proves to lenders that you are capable of managing your finances responsibly. It can be difficult to calculate how long this will take. The answer depends on a lot of factors and varies from person to person. These guidelines can help you estimate how long it will take to build credit.

Build credit starting from scratch

Building credit from scratch can be a difficult task, and it will take time. Although it can be difficult, credit is essential to allow you to finance big purchases and receive the best rates. It is a good idea to get your credit ready if you are planning on buying a house soon.

A loan can be a great way to build your credit. You should ensure that the loan is affordable and that you have the funds to repay it in full. The federal student loan can be a good option. The monthly installments should also be manageable. An income-driven plan can be used to make it easier to pay the loan off. Many people who start building credit are young adults who intend to purchase their first car. If this sounds like you, getting an auto loan can help you build your credit faster.

Building credit after bankruptcy

The question of "How long does credit take to build credit after bankruptcy?" isn't an easy one. There are several things you need to keep in mind. You should ensure that your ability to make monthly payment is a factor. This will help build your credit history.

As long as your purchases aren't major, you can start rebuilding your credit. This is best done by applying for a card. There are many credit cards available, but it is important to choose the one that suits your needs. It is important to repay 70% of your credit limit each monthly and not make large purchases. It is a good idea not to open more than six credit cards in the first six-months.

Building credit after foreclosure

Your credit score can be negatively affected by foreclosure, but that doesn't mean it has to be. A few smart steps can help you repair your credit, get approved to borrow money and obtain a mortgage. Higher credit scores will help you qualify for lower interest rates.

First, it is important to remember that foreclosure will stay on your credit report for seven years. This is because it is recorded in the section labeled "Public Information," which chronicles judgments against you. After a couple years, however, the effects of a foreclosure are less noticeable.

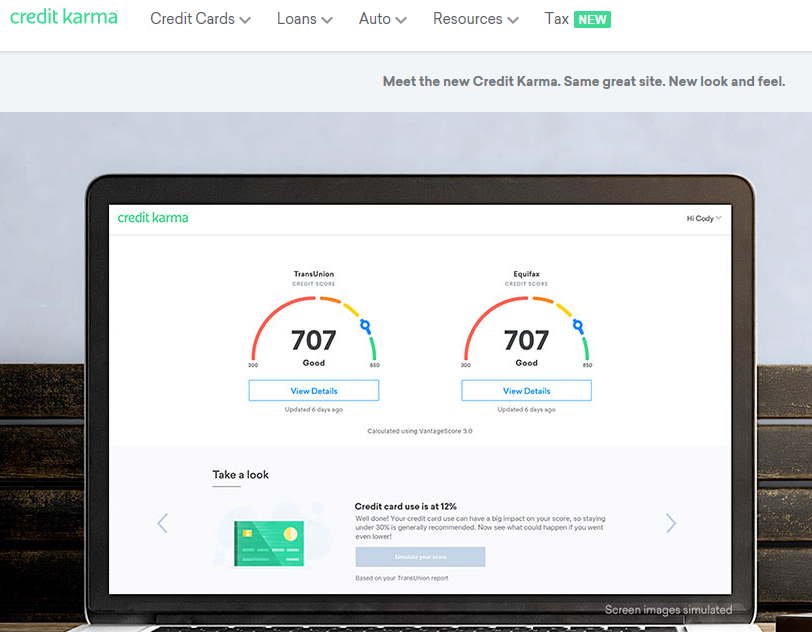

Building credit with a credit card

Building credit with a card is a tedious process. You can expect to take anywhere between one and six months to achieve a decent score. You must be patient and follow responsible credit habits. These habits include paying your bills on-time and keeping your balances low. Also, you should review your credit reports in order to fix any errors and eliminate late payments.

It is best to build credit using a credit card by keeping your balance low and paying the full amount each month. This will increase your score and lower your credit utilization. It's best to keep the balance below 30% of your total credit limit.

Secured cards are a great way to build credit

It takes time to build credit with a secured loan. Be patient and persistent in repaying your balance each month. You also need to maintain a low credit utilization ratio so you don't incur excessive debt. A secured card can help you build credit and improve your credit score.

Although secured credit cards can be a great way to build your credit history and establish credit, you will need to make regular payments. Even if there are only a handful of purchases per month, you must ensure that you pay your bills in full each month. This will prove to creditors that your are responsible and won’t use your card for carrying a balance. Your credit score will rise if you are consistent in your payments.