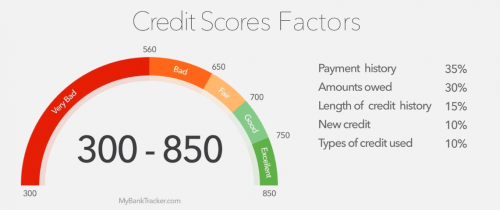

Your repayment history is one of the most important factors in your credit score. This accounts for around 35% of your overall credit score. You can improve your score by keeping your credit card balances small and making all payments on time. Automatic payments can also help. Here are some ways to improve your credit score.

35% of credit scores are affected by your payment history

Your credit score is approximately 35% dependent on your payment history. This information can help you apply for loans, but it can also hurt your score if you are consistently late on payments. Even if you have missed just a single payment, it will still affect your score, so it's important to be on time when paying your bills. Set up automatic payments for your minimum amount to improve your payment history. To ensure that you do not miss a payment, you can also set reminders.

Your credit score will improve if you keep your payments current. Don't pay more than you owe. Paying off debt sooner will result in lower monthly payments. This will allow you to keep your balance lower and lower your interest rate.

Keeping credit card balances low

A low credit card balance is one of the key components to building good credit. When you make purchases, paying the balance off before the due date will help your score. Interest is also charged by credit card companies if the balances are not paid in their entirety. A good interest rate should not exceed 18%

Credit utilization is another important aspect that impacts credit score. Experts recommend that credit utilization should not exceed 30%. This applies to both individual credit cards, as well as your total credit card use. Although it may seem high, this is a good guideline.

Automated payments

Auto payments can be a great way of improving your credit score. These auto payments will automatically make the payment for you and ensure that you pay all your bills on time. It's a great way for you to avoid missing any payments, which can impact your score and lead into additional interest. Even if you can't pay off the entire balance, paying a fixed amount every month can give you peace of mind and save you from late fees and hits to your credit score.

You should remember, however, that automatic payments can still take some time to reach the creditor and process. Late payments can result in a fee such as an overdraft charge or a refund. Pay close attention to the amount you pay each month. You can set up a reminder on your calendar to review your monthly statement and adjust your payment amount as needed.

Here are some sources to get a credit score

If you want to know your credit score, you can access it from several different sources. These scores may be incomplete or inaccurate, however. Your credit score is calculated using information from the three largest credit bureaus. This score is used by lenders when deciding whether to give you credit.

You can purchase a credit score from the major credit bureaus, as well as from third-party providers. Many of these websites offer credit scores free of charge or for a small monthly fee. In either case, it is important to check the information on your report for accuracy.