Good credit is essential for qualifying for reward cards that are competitive. The American Express Gold Card, for example, requires a score of 670 or higher. The new model should have an impact of 110 million. This is great news for those who are looking to receive the best rewards cards deals. Unfortunately, you may not be able get certain cards if the score isn’t good.

Credit history length

The length of your credit history is vital when calculating your credit score. A few open accounts are fine. However, having a long history of credit can help you improve your score. Lenders will use your credit history as a predictor of your future behavior. You will not get credit if you have a track record of late payments.

Your credit age refers to the average age of all accounts. You'll want to raise your average credit age from seven years if you have three cards: Card One is three years, Card Two is five and Card Three is one.

Frequency of new credit

The frequency of new credit score updates varies from lender to lender. Lenders typically report new information to three major CRAs approximately every 45-days, but some lenders report more frequently. The credit score updates depend on the amount of financial activity you've been involved in over a period of time. It is possible that your account balance won't be updated immediately after you have made a debit card purchase. It takes around 30 days for transactions to reach major credit reporting agencies.

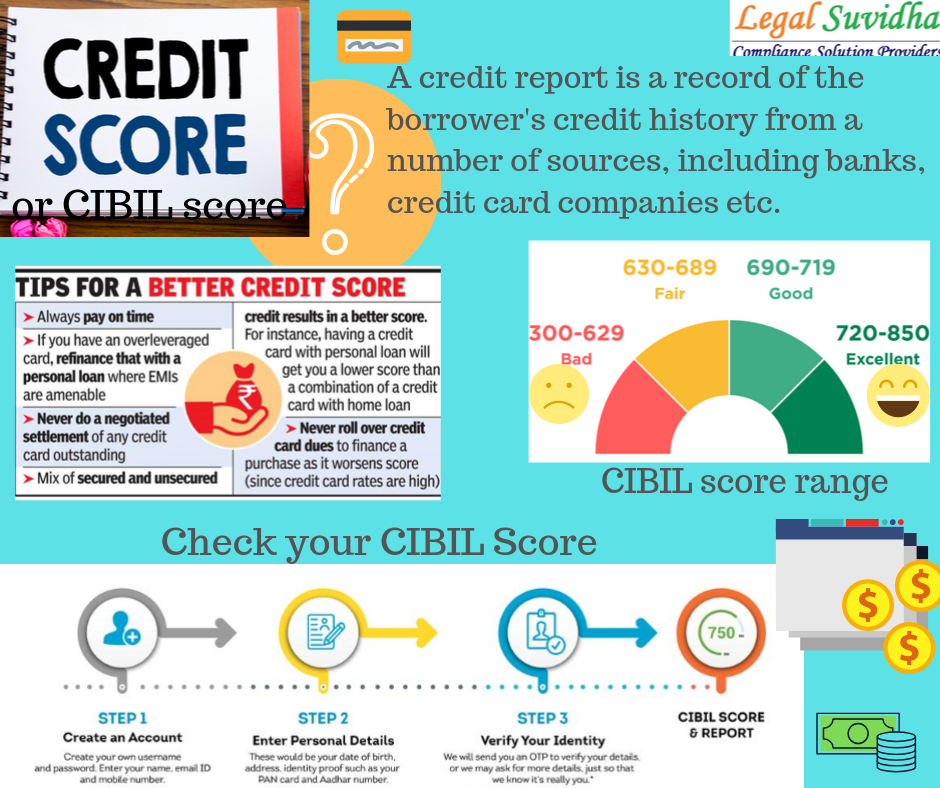

Your credit score is determined by three factors: payment history, length of credit history, and amount of debt compared to limit. Your payment history makes up about 35 percent. 15 percent is based on your credit history. Your score is also affected by the type of credit you have used and how often you make new credit inquiries.

Different types of credit

It's important to know the types of credit that you have used before applying for a credit score. Lenders are more interested in knowing that you can handle various types of credit. If you only use credit cards for paying bills, your credit score is not as high as one who has a variety of credit. Your credit score can affect many things, including whether you are able to rent an apartment or whether you can get a lower rate on your auto insurance.

Lenders assess credit scores to determine your credit risk. Lenders will assess your creditworthiness based upon five factors. This includes your credit mix. Each of these factors have different implications for your credit score.

Payment history

When calculating your credit score, it is important to consider your payment history. This helps lenders to make lending decisions by analysing your history of timely payment. You can lose your credit score if you miss payments or have collection accounts. Avoid falling into this category by making sure you pay your bills on-time.

Many creditors report your monthly payments to the credit bureaus. It is crucial to ensure that all payments are made on time so they appear on your credit reports. These late payments will still be reported, even if they are rare.

Credit score is not affected by unpaid medical bills

The amount of medical debt in the U.S. is estimated to be over $88 billion, but not all of it is reported to credit agencies. This means that some medical debt will be removed form credit reports by the end of 2022. Most of this debt results from a single, immediate medical issue. Creditworthiness does not reflect the person's creditworthiness.

Credit bureaus must wait at least one year before including unpaid medical credit on consumer credit reports. This additional time will enable consumers to pay their medical bills as well as negotiate payments with their health care providers. In addition, paid medical debt will no longer appear on a consumer's credit report for up to seven years if it was reported prior to this policy change.