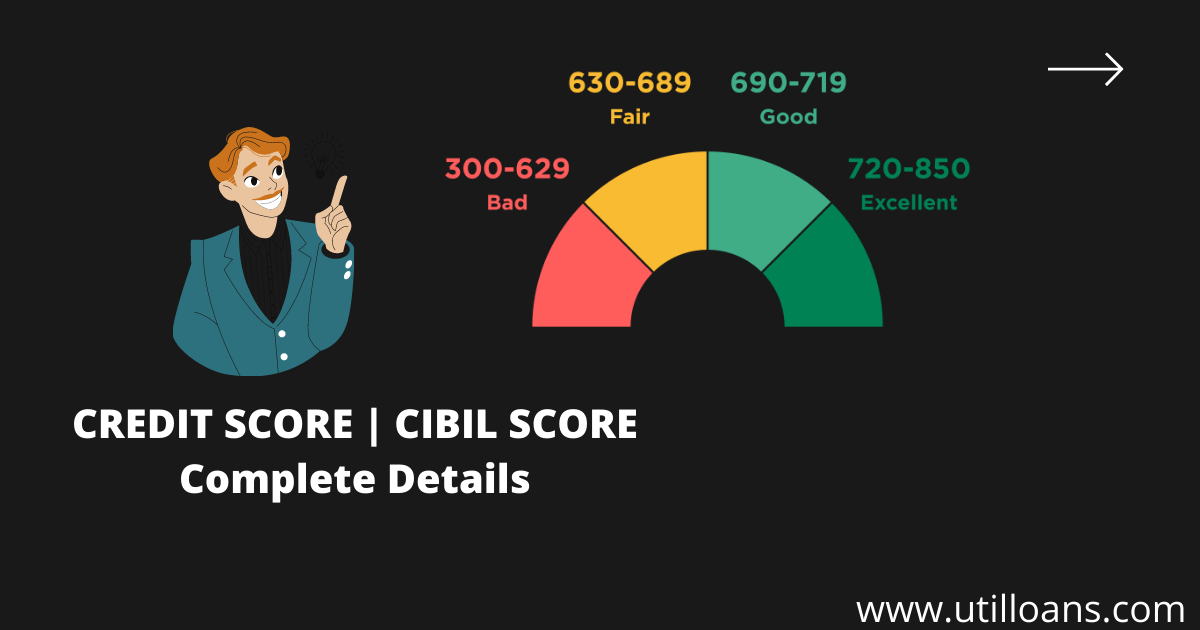

Credit-boosting cards can help you improve your financial status and raise your credit score. To improve your credit score, you need to know the best time to apply for a card and what to do with it.

The best credit cards for boosting your credit score tend to be those specifically designed for new credit users. These cards can offer you perks not found on normal credit cards such as travel benefits, sign-up bonus, or no foreign transaction fee.

The best credit-boosting card depends on both your spending habits as well as your lifestyle. Some credit boosting cards are better for people who make frequent purchases in one or more categories, like dining or groceries. Other cards are more suitable for people who buy basic goods, such as clothing or gasoline.

You need to first decide if you want a credit card that will help you build a good credit rating or simply establish one. Whatever you do, make sure that you pay all your bills promptly. You will avoid paying late fees and incurring interest, which can cost you hundreds of pounds in the long term.

Payment history is a key factor in raising your credit rating. Paying your bills promptly every month is the best way to improve your credit score, even if you do not have a large amount of credit.

You may also want to consider applying for secured cards, which allow you to build credit without putting up a security deposit. These cards report to the three main credit bureaus. However, you may need to wait a few months for them to start boosting your score.

Another option is a prepaid card, which doesn't require monthly payments but isn't as convenient as a credit card because you have to add money each time you make a purchase. Prepaid credit cards are more expensive than debit cards and unsecured credit card.

Generally, the best credit card to improve your score is one that offers a high percentage of rewards and has no annual fee. The credit limit is also higher than with other cards. This can help build credit over time.

Some of these credit cards let you charge all of your monthly bills to the card. That can simplify bill-paying and improve your score if paid on time.

Choose a card that offers cash back or a sign up bonus. These rewards usually come in the form of a statement credit. The amount you get varies depending on which card you have. Credit card rewards are particularly useful for people who don't have credit or have low scores. They encourage responsible credit behavior and can help you improve your score.