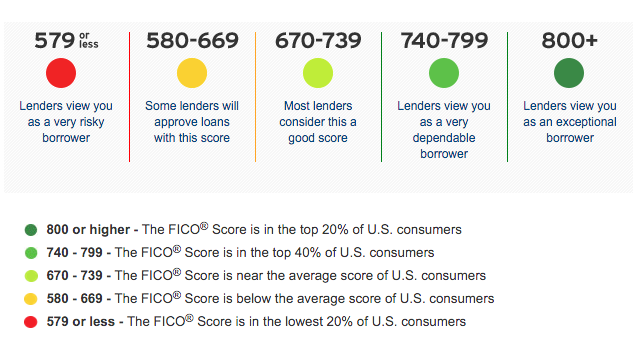

Having a good credit score but low income will not automatically disqualify you from getting a loan. Potential lenders will examine your credit history more than income, as it shows how well you manage your debt. As a result, understanding the components of your credit report is key to increasing your access to financial services.

Low income, bad credit

Many low-income households struggle with bad credit. This can make qualifying for low-income housing a daunting task. It is important that you understand that even those who have poor credit may still be able to benefit from better financial planning and a better credit score. These are some tips to help you get started. Understanding the impact of credit on your credit score is crucial. It will keep motivate you.

Pre-approval is a key step in purchasing a home for those with bad credit. This will give you an indication of your income and credit scores, so you can determine if you're qualified for a loan. Once you have received pre-approval you can start improving your score.

High income, bad credit

A combination of a low income and poor credit can make it difficult to get a loan. Even though this is not always the truth, there is a correlation. Higher credit scores are more common in high earners than those with lower incomes. In fact, the percentage of consumers with excellent credit scores increases as a function of income. A high income doesn't automatically mean you have bad credit. There are many ways to improve credit scores.

A good credit score can be overcome by a high income or a high salary. You must make at least 40 percent of your monthly rent to impress a landlord. A $300,000 annual salary can be offset with an annual income of $48,000.

High credit utilization and low credit limit

Low credit limits and high credit utilization are not good things. If you are a good credit holder, you should still be able to pay your monthly bill. A credit utilization ratio of less than 10% is considered the best.

You might be eligible to increase credit limits by calling your card issuer. Lenders may decrease your credit limit if you have a poor credit rating. You might also consider applying for a no-fee credit cards.

People with excellent credit can get loans

While it's true that a low income doesn't necessarily mean you won't qualify for loans, there are still some rules to remember. You will need to show regular income. Most lenders require proof that you are earning at least $800 to $1,000 per month. While you don't need to work full-time, you should have stable income to pay the monthly payments. You could also be eligible for Social Security benefits or disability benefits.

Repayment term is the next important factor that will affect the amount of your monthly payments. The repayment term is the next most important thing that will impact the amount of your monthly payment. It affects both your borrowing costs and your monthly payments. Make sure you choose a lender who offers a repayment plan that suits your financial situation. Online applications are possible with many lenders. This won't affect your credit score.

Lending options for those with high credit ratings

Lenders may consider various income sources to determine if you are a good candidate for the loan. These can include your Social Security benefits, retirement accounts, side gigs, and public assistance like alimony, child support, and long-term disability. Your income may not be sufficient to qualify for a loan.

Bad credit can keep you from getting a loan. It is important to raise your credit score before applying for a loan. One of the easiest ways to do this is to pay down your credit cards. This will enable you to access more cash, without having to pay interest. Credit cards can be used to pay your bills and help lower your debt-to-income ratio.