Doing multiple applications for loans can negatively impact your credit rating. Each loan application remains visible on your credit file for up to two years. The loan remains on your credit record forever if it is not repaid. This is why it is important to avoid multiple credit applications. Your credit score can also be negatively affected by rate-hopping and late payments.

Rate-shopping can affect your credit rating

It is essential to shop around for lower interest rates if you are applying to large loans, like a loan to buy a house or a vehicle. To keep your credit rating intact, there are certain rules. These rules could lead to a decrease in your credit score.

Before you submit your first application, it is important to compare rates. This will prevent you from submitting multiple applications in the same time. This will prevent multiple inquiries from impacting your credit.

Credit rating affected if you submit hard inquiries

It's possible to wonder how hard inquiries impact your credit rating, especially when you apply for loans. It's a small effect, however. Credit experts say that a hard inquire will not reduce your credit score by more than a few points. The exact amount of points you lose will depend on your credit score, and how many hard inquiries you have.

Two years will pass before a hard inquiry appears on your credit report. Although they won't immediately affect your credit score, hard inquiries will be there for at least two years. However, they'll continue to affect your score for approximately one year. Unauthorized inquiries can still be challenged at a credit disputes center. Unauthorized hard inquiries can be the result of a lender pulling your credit report without permission, or they may be the result of identity theft.

Late payments can impact your credit rating

Late payments on credit card and loan accounts can impact your credit rating. Avoiding this problem is to pay your debts as soon as possible. If you are able to pay off an overdue account within thirty days, you will avoid the negative impact that late payments can have on your credit score. However, if you are unable or unwilling to make the payment, you might have to pay a late payment fee, or have your account reported and collected by a collection agency.

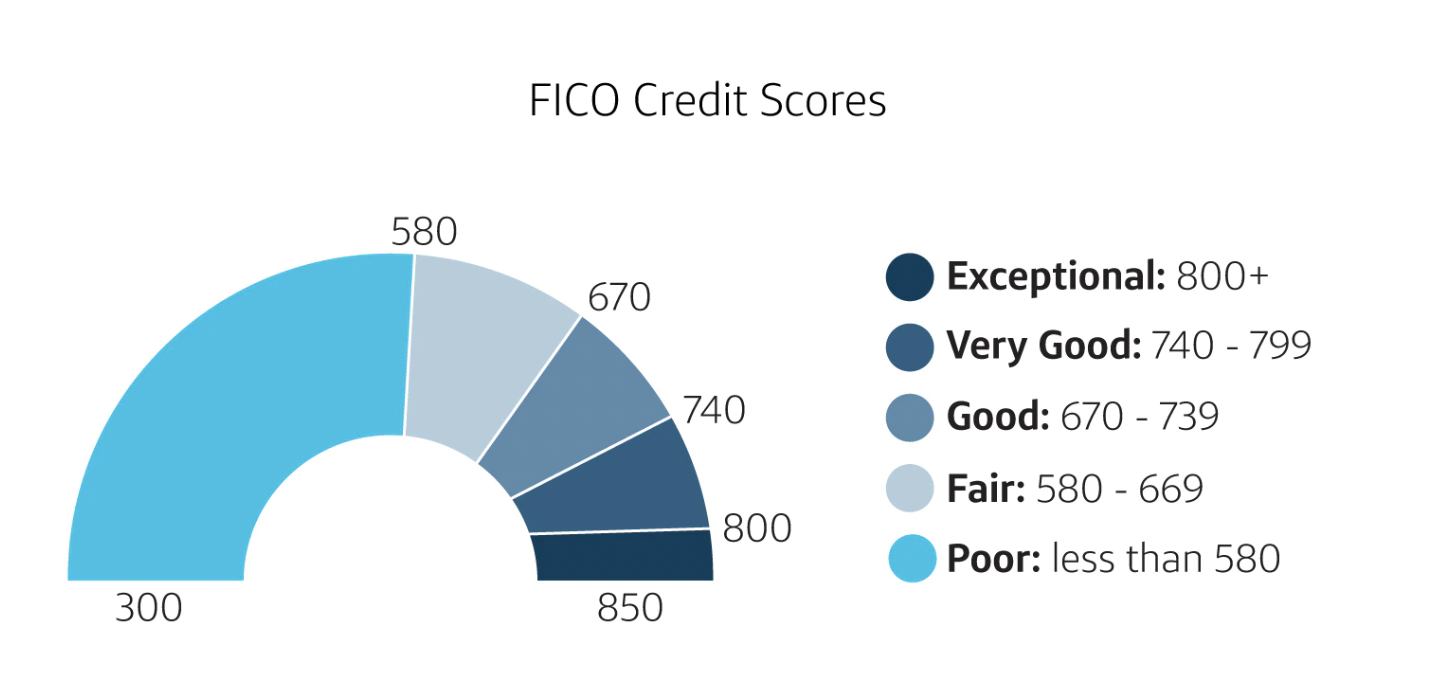

Credit score calculations consider many factors in determining whether someone will be able repay debts. Payment history accounts for as much as seven years. A late payment can lower your score by up to 100 points. The impact on your credit score will be less if it is already low. In some cases, financial emergencies (such as job loss) can lead to a missed payment. You should seek out assistance and strategies to make up the payment that was missed if you find yourself in this situation.

Avoid making a tough inquiry

Knowing how hard inquiries affect credit scores is the first step in avoiding an inquiry when applying to for loans. While each inquiry does impact your score, there are several ways to minimize the impact. Avoid applying for loans until you are certain you will be approved. Pre-qualification services are offered by some lenders that do not require a hard inquiry. This can help you decide if you qualify for a loan.

Another way to avoid a hard inquiry is to make sure you apply for only one type of loan at a time. One hard inquiry can reduce your score by a couple points. But, if you ask for multiple loans within the same 12-month period, it will have a greater impact. There are many other types of credit inquiries that will not affect your score. One example is when a potential employer makes a soft inquiry. However, before you allow your prospective employer to conduct a soft inquiry, you should obtain your consent in writing.

A personal loan can help improve your credit score

While you may be concerned about your credit score, it is actually possible to improve it by taking out a personal loan. This loan can improve credit scores because it lowers credit utilization. This ratio is what determines your credit score. Many people have high credit utilization rates. This ratio can be improved by reducing your credit card debt and avoiding maxing out your cards.

Another way to improve your credit score is to pay off your existing balances. This will allow you to reduce your credit card balance, and it will make you more trustworthy. This strategy can lead to more personal loan debt.