There are very few credit cards available after filing bankruptcy. A secured credit card will be available if you aren't fully rehabilitated. It will require a cash deposit. These credit cards can help you rebuild creditworthiness and improve your score. You can apply for a credit card post-bankruptcy to improve your score.

Capital One Platinum Secured

Capital One offers a card with a very low security deposit. The deposit is usually between $49 and $200, depending on your overall credit score. It also boosts your spending limit by the same amount. This credit card is available to anyone, even bankrupts, provided that they are willing to pay the security deposits.

Capital One Platinum secured credit card is available for applicants with low credit scores. Applicants must have a checking account or savings account in order to avoid being denied. Applicant must also prove that they can afford their monthly expenses. If this sounds difficult, an alternative is to apply for a credit without a banking account, such the Green Dot Visa(r), Secured card. These credit cards are available to deposit cash at any participating store. They can also be used for free checks.

Get it Secured

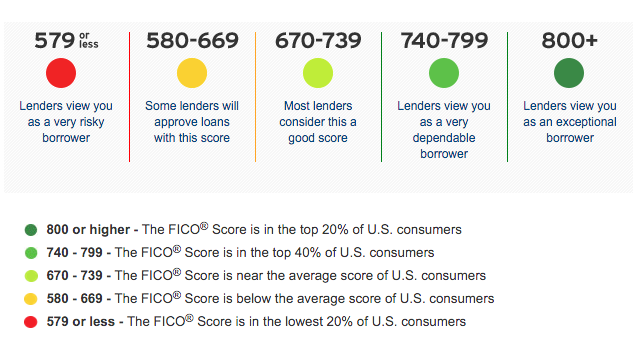

If you are trying to rebuild your credit after filing for bankruptcy, you should consider a credit card like the Discover it Secured credit card. Its features and rewards make it a good choice, and there is no annual fee. You don't have to pay late fees or foreign transaction fees with this card. You also have free access to your FICO Score.

You should make timely payments as you rebuild your credit. Also, ensure that you are responsible about your purchases. You should start small purchases every month with secured credit cards, as they have lower credit limits. This will help to establish a payment history that is stable and prove lenders that you do not depend on credit.

Secured Visa OpenSky

OpenSky Secured Visa bankrupt credit card for those with poor credit is an excellent option. The card can be applied for with a credit card or Western Union. To get started, you will need a $200 to $3,000 security deposit. OpenSky will mail your card once the money is received. It may take two to three weeks before you receive it.

One of the greatest benefits of the OpenSky Secured Visa for bankrupt credit card is that there is no credit check or checking account required to apply. For approval, you will only need a $200-$3,000 refundable deposit. The deposit will be used to limit your credit. The card will be approved as long as you meet the requirements, even if it has a low credit rating.

Rebuilding Credit with Capital One Platinum Visa

For people with poor credit, a credit card that pays cash back is a great option. You can earn one percent cashback on all your everyday purchases with the Platinum Visa from Credit One Bank However, it is important to be aware of the card's conditions and fees. Rates and fees that are unexpected are quite common. You should not apply for the card unless you have been prequalified.

Capital One offers credit cards to people who have been through bankruptcy. Their Platinum Visa for Rebuilding Credit has a low interest rate and no foreign transaction fee. Credit Protection Program is designed to protect your credit score and prevent it from falling as you rebuild.