Credit One Bank Visa is an excellent option for anyone who wants to earn cash back when they make purchases. It also offers a number of cards which are designed for people who have low or no credits, helping them to rebuild their credit.

Credit One has been around since 1984 and offers more than 5,000,000 active credit cards. They offer a variety of cards, including ones with no annual fee and ones that are targeted at certain categories like travel or shopping.

It is important to remember a few factors when deciding on a card. You should also consider the terms and conditions of the card, as well as how long you will have a grace-period and if interest is charged on new purchases.

The grace period is the time you have before your credit card charges interest. You can call Customer Service to see if the card you use offers a Grace Period.

The grace period that applies to new purchases will vary depending on which card you use, but generally speaking it means that interest is not charged until the billing date. However, there are cards that don't offer this grace period and will charge you interest on purchases as soon they post to your account.

If you want to change the due date every month, call Customer Service. You can choose a date that is six days earlier or later than the original due date.

Another important detail to consider is the credit card's cash advance fee. Cash advances can be charged by some cards at no cost or for a low fee, but others charge more. There are also cards that charge foreign transaction costs, which can increase your international shopping costs.

The Credit One Bank Platinum X5 Visa offers a rewards program that is free of annual fees and no fee. This card comes with an attractive rewards system and a minimal annual fee. But you have to ensure that your spending patterns will be eligible for the bonus cashback rate.

It is best to check out Credit One's website first and see if you are pre-approved for a card before you apply. Credit One will then display the full terms and conditions for the card on its website.

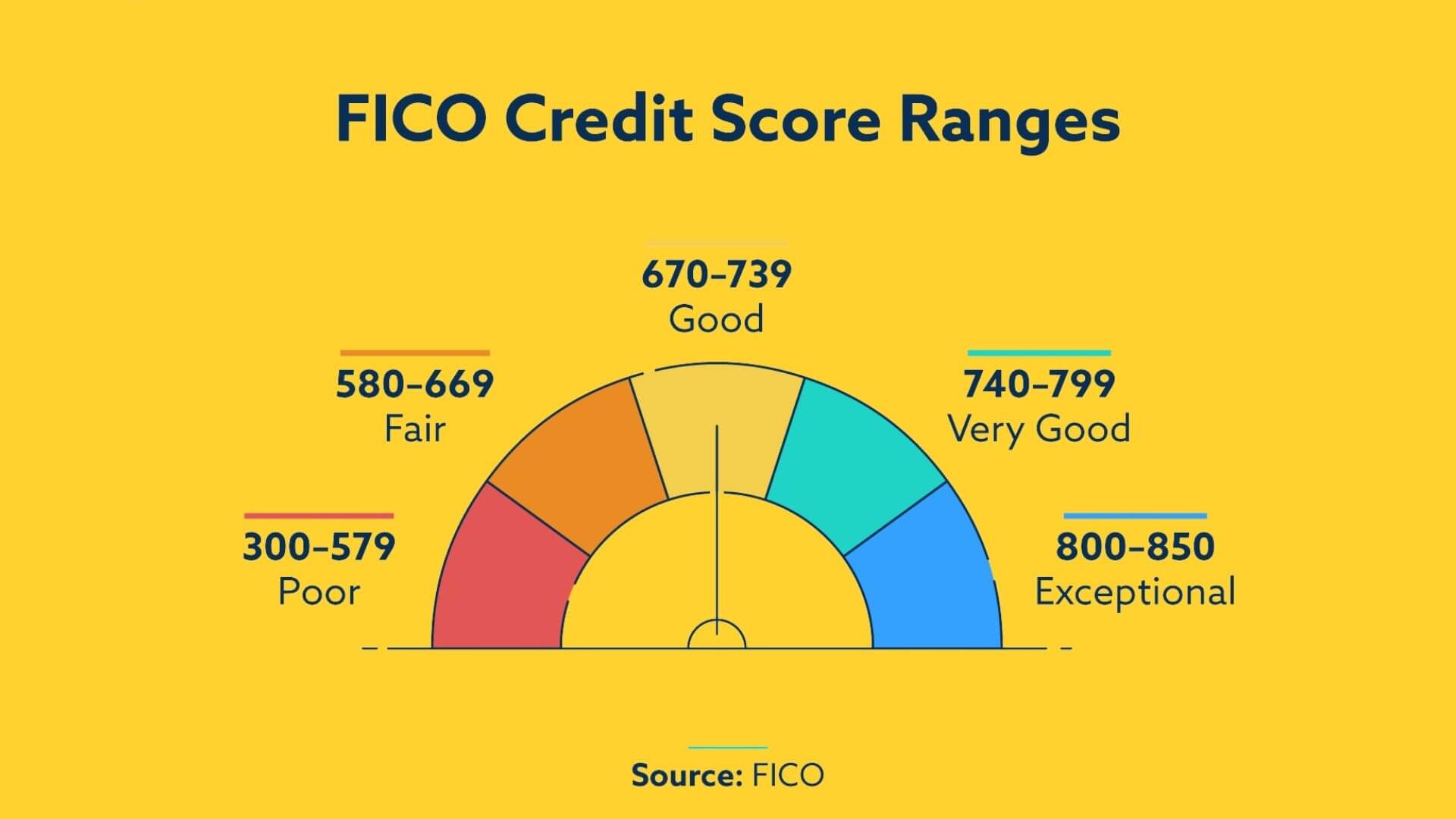

Credit One Bank Platinum Visa for Rebuilding Credit (designed for people with fair-to-poor credit) is the best one. It offers a low-limit credit and allows for periodic review of your credit limit.

The card has a welcome bonus of 10,000 points after spending $1,000 on eligible purchases in the first 90 days of opening the card. These points are redeemable for travel, gift certificates or statement credits.