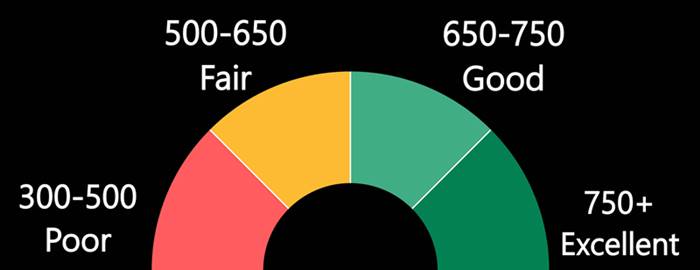

If you are thinking about signing up for an Authorized user account, you may be wondering how these accounts can improve your credit score. Authorized users don't have to pay monthly payments because they aren't legally responsible for any balances on accounts they have been given permission to use. However, by using a credit card for purchases, they can build up their credit history.

Authorized users are able to make purchases on their behalf

It is a smart move to add your child or teen as an authorized credit card user when they are old enough. This is a great way to teach them about personal finance, debt management, and responsible borrowing. These lessons are crucial for college students and young people. It can be a good idea to add students to your account, but it can also prove difficult.

The addition of an authorized user can have a significant impact on your credit score. Credit utilization plays a major role in determining your credit score. Example: If you have $1,000 in credit and make $300 per month, this means that you're using 30%. The best way to reduce your overall utilization is to add an authorized user.

They're not legally responsible for the balance

A cardholder authorized user is not legally responsible for any balance on the card, unless they make unauthorized purchases and charge an item that the original cardholder hasn't authorized. A spouse of an authorized user may be held responsible in some states for the debt if they die. In addition, in community property states, an authorized user may be a joint account holder and therefore equally responsible for the debt on the account.

If the primary account holder isn't happy with an authorized user charging anything, they can have them removed. It's typically as simple as calling the customer service number or filling out an online form. Some card issuers do not allow authorized users to be removed from their accounts.

They don't have to make payments every month

It's possible to build credit by adding an authorized user on your credit card account. Authorized users are able to take advantage of the good payment record of the primary account holder. The authorized user will see a positive credit score as long they make all their payments on-time. However, credit card issuers do not always report authorized accounts to credit bureaus.

One option for you is to add a family member to your credit card. This person will not be able to use the card for any unrelated purchases. The credit limit can be maintained so long as the card is used only for legitimate purchases.

They can also create credit histories

Be careful when you're considering being an authorized user for someone else's credit cards. This type of account is not recommended for reckless use. Your credit score will improve if you use it responsibly.

Your credit score can be improved by adding an authorized person to your credit cards account. This will increase your ability to get products at lower rates and improve your credit rating. But, late or missed payments can have a negative effect on your credit. Consider applying for a secure credit card in this instance.