Here are the factors that make up a fair score on credit. We'll be discussing Credit utilization ratio, Payment history and payment frequency in this article. We will also discuss credit bureaus and ways to improve your score. A good credit score can open up many doors for you in the future.

Credit utilization ratio

One way to calculate credit utilization ratios is to use them as a tool. These are calculated using your credit card debts divided by your total credit. This information is often found by going to your credit card account. If you have several revolving lines of credit, you can also check each account's credit utilization ratio and then add up the figures for an overall percentage.

Payment history

A credit score is a crucial part of getting a loan, or credit card. Although you might be eligible for a loan and credit card with a fair credit rating, you will likely pay more in interest. Higher credit scores may allow you to qualify for lower interest rates and terms.

Payment frequency

A fair credit score is a good place to start. But, with patience, you can easily improve your credit score. It is important to be consistent with your payments and keep them on track.

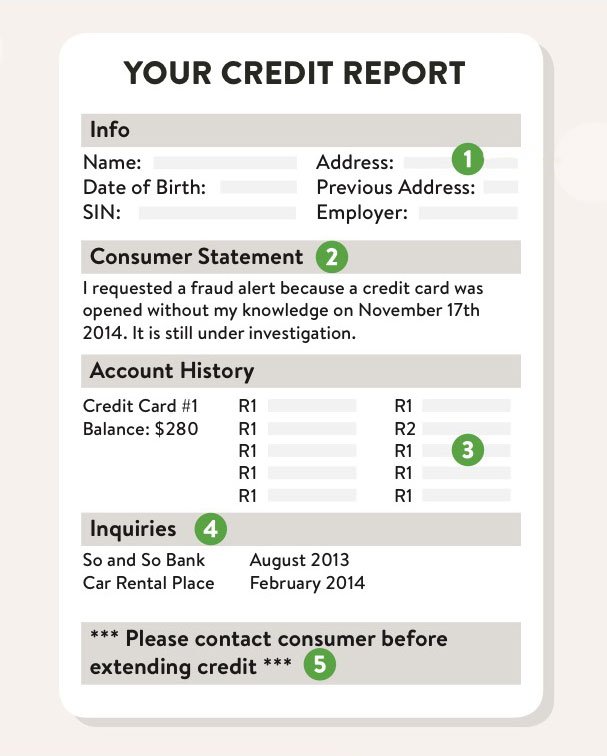

Credit bureaus

The Fair Credit Reporting Act was created to ensure that credit bureaus are not putting untrue information about you on your credit report. Critics argue that the three credit reporting agencies have effectively been turned into an oligopoly with consumers not being able to choose which credit bureaus can access their credit score or data. The federal law requires these companies to correct inaccurate information within seven days of discovery.

Interest rates

Your credit score can play a significant role in whether or not you are approved for credit cards. Lenders could consider you subprime if your credit score is low. In this case, you will likely pay higher interest rate. You may be eligible for lower rates and terms if your credit score is higher.

Loan eligibility

Look for personal loans providers that have fair credit scores. If you are looking for a lender that requires a low credit rating and offers prequalification, it is worth doing your research. These lenders have a key feature: prequalification allows you to share your information without having to go through a credit check. This can temporarily lower your score. Before you apply for a loan you can get prequalification.