A bad credit card offers high interest rates and is not recommended. This type of card should not be used. It can cause credit problems. Fortunately, there are a number of better alternatives, including cards with 0% introductory APR promotions for purchases and balance transfers. Before you apply, read through the terms and condition.

Better credit cards may offer 0% introductory APR promotions on purchases and/or balance transfers

A 0% introductory APR credit card offer is a great way to reduce the cost of carrying a balance each month. If you don't pay the balance in full before the introductory rate expires, you could be subject to interest. You can also set up automatic monthly payment to quickly pay off the balance. Although this might seem like a complicated process, it can help you achieve debt freedom sooner.

Be sure to carefully read the terms before you take advantage of a balance transfer promotion with a 0% interest rate. The terms should cover the fee for balance transfers, the length of time you have to pay off the balance, and what happens to your balance after the introductory APR period ends. If you have any questions about the terms, call the card issuer.

Signs of a bad credit card

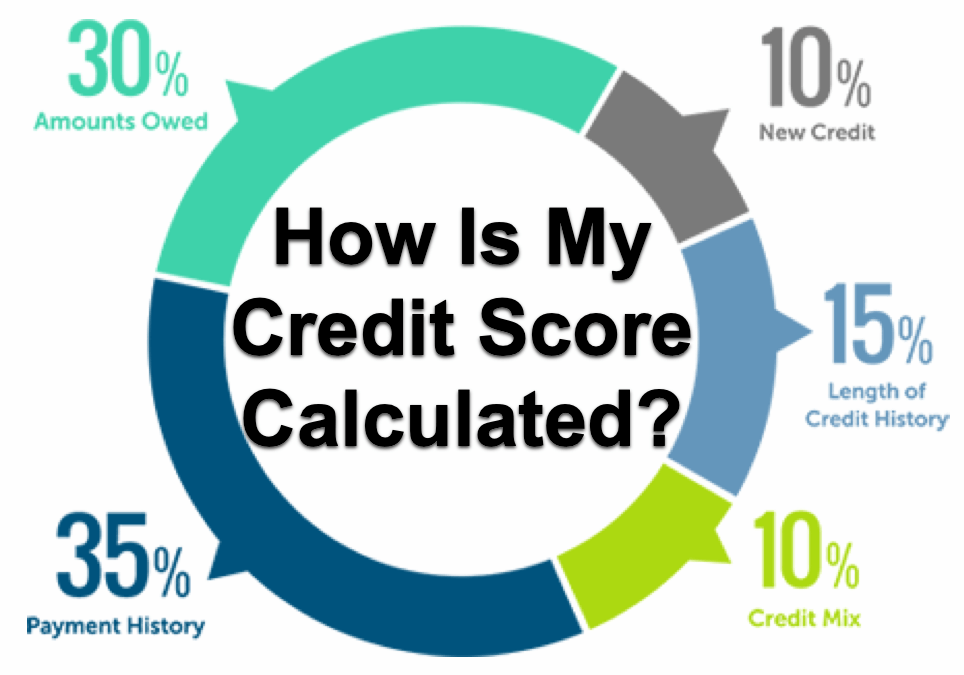

Signs of a bad credit card include high interest rates, penalties, and an escalating debt. They can also be very costly and have little to no rewards. This can lead to a negative credit rating. Regardless of whether you're looking for a credit card to start building credit or improve your current score, you should avoid getting one that has these characteristics.

The cost of a poor credit card

Be aware of all costs involved when applying for a credit-card with poor credit. These cards do not offer any sign-up bonuses or rewards. They also require that you put down a deposit ranging from $200 to $5,000. This money acts to increase your credit limit and is required when opening an account. These cards are not able to offer you the rewards you seek, but they can give you the opportunity to improve your credit.

When evaluating different credit cards, you should consider the fees and APR. Check out the annual and monthly maintenance fees. These fees are unnecessary and may be an expense you don't need. You should look for cards with low interest rates to ensure that you don't pay a lot in interest.

Approval for a card with bad credit

One of the best ways to rebuild your credit is to get approved for a new credit card. However, there are a few things you should keep in mind before you apply for a new card. Consider your ability to pay security deposits or other fees. Also, be aware of any rewards offered by the cards.

A secured credit card is another option. A secured card will require a deposit that is returned to the issuer if you do not pay off the balance. This is a great option for those with poor credit as it allows them to repay their balances over time. Be aware that obtaining a secured card approval is not always guaranteed. You may be denied this type of credit card if you have serious credit issues or bankruptcy.

Avoiding fees when you have a bad score

There are several ways you can avoid fees from a bad card. Avoid cash advances and balance transfers. This is one of the best ways to avoid fees. These fees can be exorbitant. A fee may also apply to purchases made in a foreign currency.

If you find yourself in this type of situation, you should contact credit card companies to inquire about ways you can avoid paying fees. These fees can be waived if you show your research. You may also be able to negotiate a lower APR.