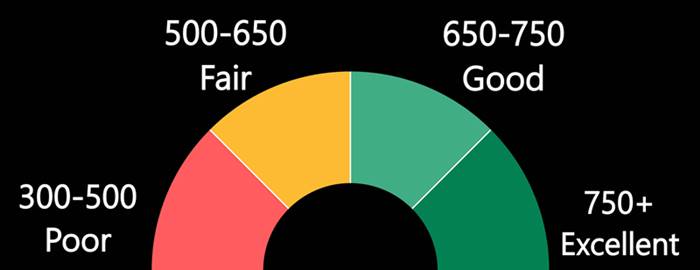

If you have a credit history of at least six months, you should be able to view your credit score online. The three main credit bureaus and some third-party score providers provide this information. It is possible to not see your score or there may be a technical glitch. This is normal and will not result in you being penalized.

Why you won't be able to see your credit score

There are several reasons you may not be able to see your credit score. If you have just paid off a loan, it is possible that you have been subject to a hard inquiry, which temporarily lowers the score. Because you have a shorter credit record, paying off a loan could also lower your score. This is significant because 10% of your credit score depends on how old your accounts are, so repaying a loan could lower your score.

Another reason you can't see your credit score is that you don't have enough information on your credit report. Some lenders may not report account activity at all to all three credit reporting agencies. This could cause inaccurate information on your credit reports. In addition, your score is not calculated based on recent activity, and your credit history may be outdated or incomplete.

Technical glitches

Lenders evaluate credit scores in order to determine if a potential borrower is a candidate for a loan. Sometimes technical problems can prevent lenders from accessing the data. Equifax is a multinational consumer credit reporting company. The latest glitch affected over 1 million people. It resulted in increased interest rates and denied loan applications. Despite its effect, however, the company has since remedied the issue.

It's not ideal, but it is a good idea to immediately contact your credit reporting agency to learn what happened. In recent years, several companies have suffered data breaches that compromised consumer information. Equifax exposed 150 million Americans' financial records in one instance. The company settled for $700m. The affected consumers received four years free credit monitoring, up to $125 cash and four year's worth of free credit monitoring. Equifax did not respond to Money's request for comment, but it does recommend that consumers check their credit reports regularly.

Equifax may still be facing problems with the Consumer Financial Protection Bureau, even though it has now fixed the initial issue. The bureau is investigating the three major credit-reporting companies. The glitch affected nearly 2.5 million consumers within three weeks. Mortgage lenders typically view scores from all three companies.

Credit bureau error

If you believe that your credit report contains an error, you have the right to dispute it. This can be done by contacting your bureau and providing further information. In some cases, however, the bureau will not approve of your dispute and will remove it from your credit report. However, if the bureau makes a decision that is not in your favor, you have the option to dispute it again by providing more information.

While errors won't affect your credit score in most cases, they could affect your ability to obtain credit in the future. To prevent further damage, it is a good idea to dispute errors in your credit reports. Although this process may take a while, it's free and easy. Contact the bureau immediately if your credit report contains incorrect information.

You can contact the data furnisher if the credit bureau doesn't correct the error. This is the financial institution which provided the data to credit bureaus. The data furnisher should be included in your credit report. The data furnisher will have 30 days to investigate your claim. They will have to remove incorrect information from the report if they find it.